Llc Vs Trust For Estate Planning . trusts legally hold and protect assets for beneficiaries. family llcs and trusts serve distinct purposes in estate planning. a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. Trusts can handle many types of. whether an llc or trust is the best option for your family’s particular needs will depend on the kind of assets you need to protect and your. llcs are better at protecting business assets from creditors and legal liability. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. A trust acts like a private will substitute, protecting assets. Llcs are business entities that can also manage family. llcs provide operational flexibility and liability protection for businesses and investments.

from www.baronlawcleveland.com

Llcs are business entities that can also manage family. whether an llc or trust is the best option for your family’s particular needs will depend on the kind of assets you need to protect and your. A trust acts like a private will substitute, protecting assets. family llcs and trusts serve distinct purposes in estate planning. llcs provide operational flexibility and liability protection for businesses and investments. llcs are better at protecting business assets from creditors and legal liability. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. Trusts can handle many types of. trusts legally hold and protect assets for beneficiaries. a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes.

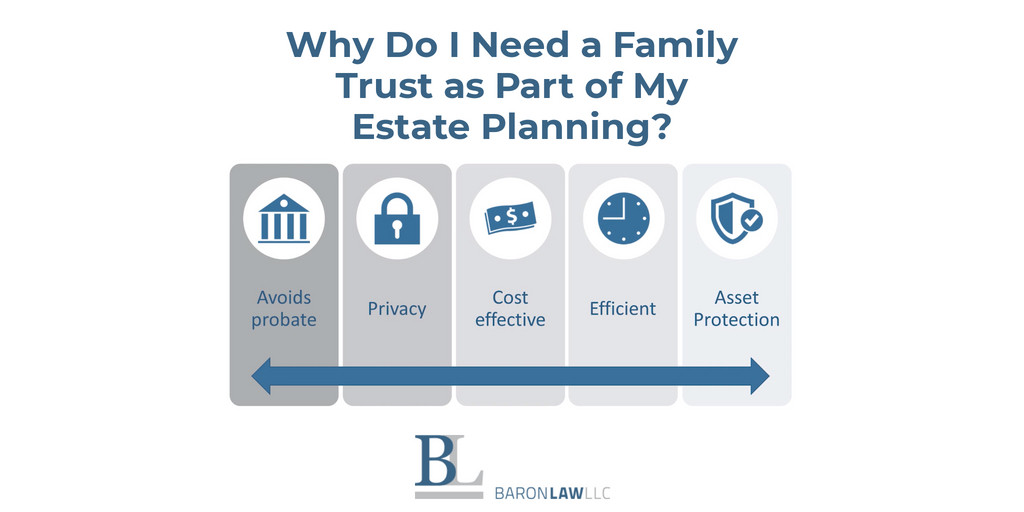

Why Do I Need a Family Trust as Part of My Estate Planning? Baron Law

Llc Vs Trust For Estate Planning trusts legally hold and protect assets for beneficiaries. Trusts can handle many types of. Llcs are business entities that can also manage family. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. llcs provide operational flexibility and liability protection for businesses and investments. family llcs and trusts serve distinct purposes in estate planning. a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. A trust acts like a private will substitute, protecting assets. trusts legally hold and protect assets for beneficiaries. llcs are better at protecting business assets from creditors and legal liability. whether an llc or trust is the best option for your family’s particular needs will depend on the kind of assets you need to protect and your.

From www.slideserve.com

PPT Estate Planning Wills and Trusts PowerPoint Presentation, free Llc Vs Trust For Estate Planning a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. A trust acts like a private will substitute,. Llc Vs Trust For Estate Planning.

From trustandestatematters.com

Estate Planning Trusts Trust and Estate Matters Llc Vs Trust For Estate Planning Llcs are business entities that can also manage family. A trust acts like a private will substitute, protecting assets. family llcs and trusts serve distinct purposes in estate planning. llcs provide operational flexibility and liability protection for businesses and investments. when you set up a trust for asset protection or estate planning purposes, you can put a. Llc Vs Trust For Estate Planning.

From theretirementsolution.com

Trust and Estate Planning The Retirement Solution Llc Vs Trust For Estate Planning A trust acts like a private will substitute, protecting assets. family llcs and trusts serve distinct purposes in estate planning. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. Trusts can handle many types of. Llcs are business. Llc Vs Trust For Estate Planning.

From mcws-law.com

Estate Planning Basics Will vs. Trust McWilliams Law Group Llc Vs Trust For Estate Planning llcs are better at protecting business assets from creditors and legal liability. trusts legally hold and protect assets for beneficiaries. Llcs are business entities that can also manage family. a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. A trust acts like a private will. Llc Vs Trust For Estate Planning.

From tuckerallen.com

Wills & Trusts TuckerAllen Estate Planning Attorneys Llc Vs Trust For Estate Planning when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. Trusts can handle many types of. family llcs and trusts serve distinct purposes in estate planning. Llcs are business entities that can also manage family. llcs provide operational. Llc Vs Trust For Estate Planning.

From www.pinterest.ch

Living Trust vs. Will Which Is Best for Me? Llc Vs Trust For Estate Planning llcs are better at protecting business assets from creditors and legal liability. Trusts can handle many types of. a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. family llcs and trusts serve distinct purposes in estate planning. when you set up a trust for. Llc Vs Trust For Estate Planning.

From estatelawatlanta.com

Wills vs Trusts Free Downloadable Guide Siedentopf Estate Planning Llc Vs Trust For Estate Planning family llcs and trusts serve distinct purposes in estate planning. llcs are better at protecting business assets from creditors and legal liability. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. Llcs are business entities that can. Llc Vs Trust For Estate Planning.

From www.lrmmt.com

Estate Planning Your Guide to SeeThrough Trusts Lowthorp Richards Llc Vs Trust For Estate Planning A trust acts like a private will substitute, protecting assets. Llcs are business entities that can also manage family. llcs are better at protecting business assets from creditors and legal liability. llcs provide operational flexibility and liability protection for businesses and investments. trusts legally hold and protect assets for beneficiaries. a limited liability company (llc) is. Llc Vs Trust For Estate Planning.

From theblacklawcompany.com

Trust & Estate Planning The Black Law Company Trust Lawyers Llc Vs Trust For Estate Planning trusts legally hold and protect assets for beneficiaries. family llcs and trusts serve distinct purposes in estate planning. Trusts can handle many types of. llcs are better at protecting business assets from creditors and legal liability. llcs provide operational flexibility and liability protection for businesses and investments. A trust acts like a private will substitute, protecting. Llc Vs Trust For Estate Planning.

From www.southfloridalawpllc.com

Understanding Trusts and Their Impact on Estate Planning South Llc Vs Trust For Estate Planning Trusts can handle many types of. trusts legally hold and protect assets for beneficiaries. A trust acts like a private will substitute, protecting assets. Llcs are business entities that can also manage family. llcs provide operational flexibility and liability protection for businesses and investments. a limited liability company (llc) is used to pass assets to loved ones. Llc Vs Trust For Estate Planning.

From www.brazoslawyers.com

Wills vs. Trusts A Quick & Simple Reference Guide Peterson Law Group Llc Vs Trust For Estate Planning llcs are better at protecting business assets from creditors and legal liability. a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust,. Llc Vs Trust For Estate Planning.

From www.georgiaestateplan.com

Marietta Trust Lawyer What’s the difference between a Revocable Trust Llc Vs Trust For Estate Planning Llcs are business entities that can also manage family. llcs provide operational flexibility and liability protection for businesses and investments. family llcs and trusts serve distinct purposes in estate planning. whether an llc or trust is the best option for your family’s particular needs will depend on the kind of assets you need to protect and your.. Llc Vs Trust For Estate Planning.

From parkerlawsc.com

Types of Trusts For Estate Planning Parker Law, LLC Llc Vs Trust For Estate Planning llcs are better at protecting business assets from creditors and legal liability. llcs provide operational flexibility and liability protection for businesses and investments. whether an llc or trust is the best option for your family’s particular needs will depend on the kind of assets you need to protect and your. A trust acts like a private will. Llc Vs Trust For Estate Planning.

From www.ashdinlaw.com

Estate Planning Part 3 The Use of Trusts in Estate Planning Ashdin Law Llc Vs Trust For Estate Planning when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. Trusts can handle many types of. A trust acts like a private will substitute, protecting assets. family llcs and trusts serve distinct purposes in estate planning. trusts legally. Llc Vs Trust For Estate Planning.

From www.leonicklaw.com

Advanced Estate Planning Estate planning attorney Long Island Llc Vs Trust For Estate Planning trusts legally hold and protect assets for beneficiaries. llcs are better at protecting business assets from creditors and legal liability. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. whether an llc or trust is the. Llc Vs Trust For Estate Planning.

From trustcounsel.com

Estate Planning 101 Wills vs. Trusts Estate Planning & Probate Attorneys Llc Vs Trust For Estate Planning when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. family llcs and trusts serve distinct purposes in estate planning. whether an llc or trust is the best option for your family’s particular needs will depend on the. Llc Vs Trust For Estate Planning.

From www.youtube.com

LLC versus a Trust? Here are the Basics.... YouTube Llc Vs Trust For Estate Planning a limited liability company (llc) is used to pass assets to loved ones while avoiding or minimizing estate and gift taxes. trusts legally hold and protect assets for beneficiaries. llcs provide operational flexibility and liability protection for businesses and investments. Trusts can handle many types of. Llcs are business entities that can also manage family. whether. Llc Vs Trust For Estate Planning.

From blog.wfplaw.com

Estate Plan vs. Living Trust Wild Felice & Partners, PA Attorneys Llc Vs Trust For Estate Planning Trusts can handle many types of. llcs provide operational flexibility and liability protection for businesses and investments. when you set up a trust for asset protection or estate planning purposes, you can put a lot of different things into that trust, including liquid capital, stocks and. Llcs are business entities that can also manage family. whether an. Llc Vs Trust For Estate Planning.